Will Nifty end the Dull August Expiry on explosive note ?

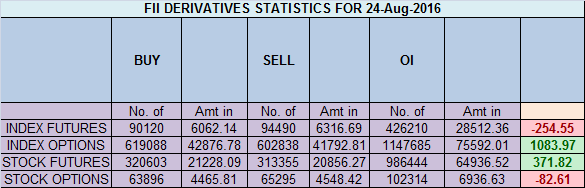

- FII's

sold 4.3 K contract of Index Future worth 254 cores ,3.5 K Long

contract were added by FII's and 7.8 K short contracts were added by

FII's. Net Open Interest increased by 11.4 K contract, so rise in

market was used by FII's to enter long and enter shorts in Index

futures. Bitter Truth about Trading

As discussed in Yesterday Analysis Now

Bulls need to close above the range of 8711 for next move towards

8779-8800-8851. Bears will get active on close below 8484 only. Its

been 22 days we have traded in range of 204 points 8517-8721, suggesting

market is seeing time correction frustrating traders and hitting SL,

traders who survive this phase by applying risk and money management

are rewarded handsomely in the next move .Low made today was 8580 near

our important gann level of 8577 which we have discussed many time in

our past analysis and also formed hammer candlestick near gann trendline

as shown below. High

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home